Case Study

Regus

Fully Serviced Office provider with 3000+ locations internationally.

Local real estate of 35,000 sq.ft. leasable space with multiple tenants.

Problem

Increase revenue in the market without adding additional real estate locations and overhead while maintaining a 90% or higher occupancy rate on 35,000.00 sq. ft. of existing space.

Sell the company’s global portfolio to local fortune 500 companies in the twin cities market. My expertise in sales, design, project management, and working with large corporate companies allowed me to create results.

My Role

Global Accounts

Sales and Leasing Manager

Project Management

Supervise team of 6

Action

My Research began by identifying local fortune 500 companies with national and international offices requiring shorter lease terms (36 months or less) with square foot requirements up to 3,000.00 feet. The ideal client emerged with market entry, acquisition, expansion, or companies with I.T. or sales teams that needed access to multiple locations nationally and internationally.

I created a strategic plan and identified companies and demonstrated a cost savings of 15-20% with their real estate portfolios.

Clients included:

Retek, United Health Care, American Express, Ameriprise, and ADC.

The Results

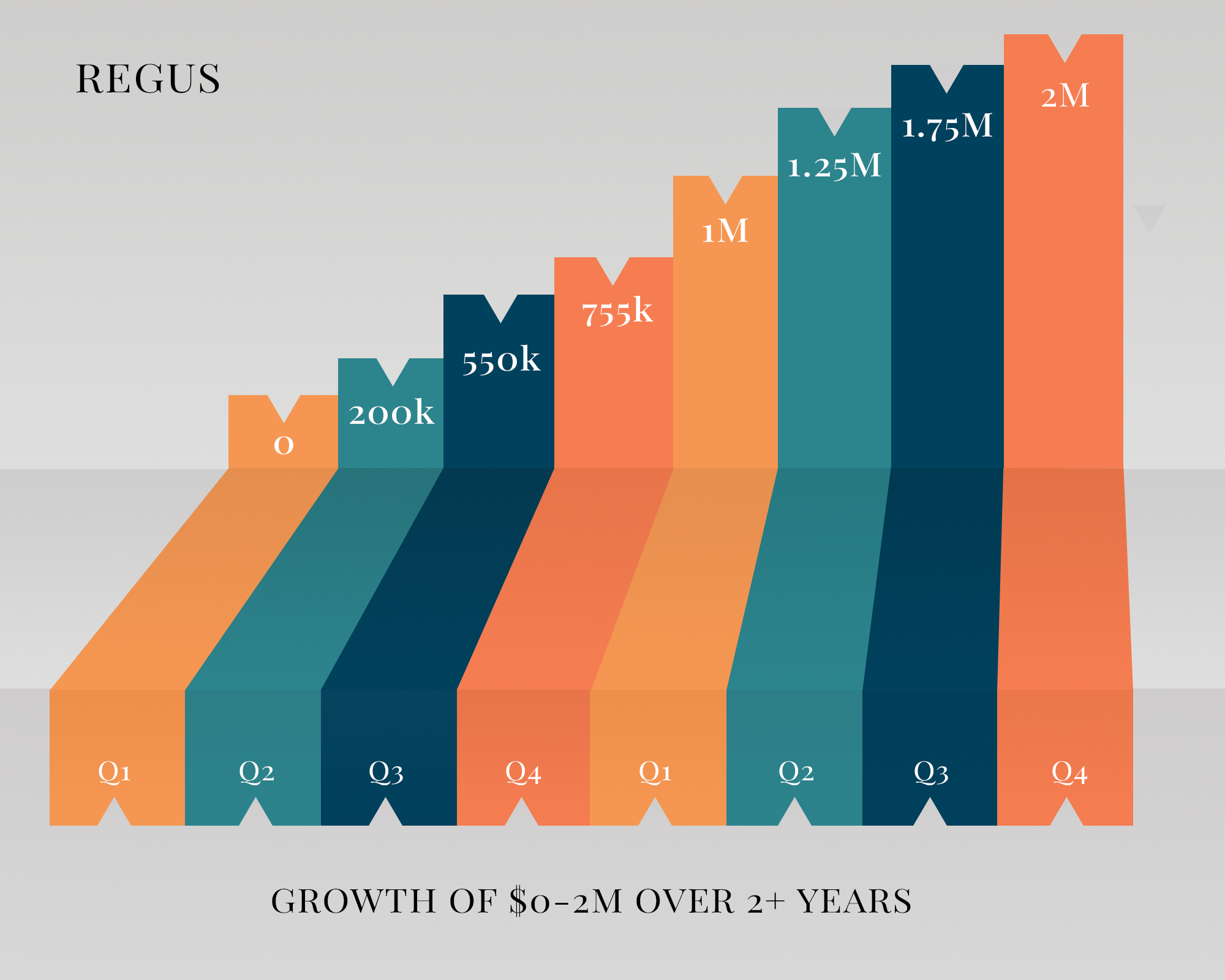

Grew Global account base from $0-2M will maintain 90% occupancy or higher with local real estate tenants and increased local revenue by selling additional services.

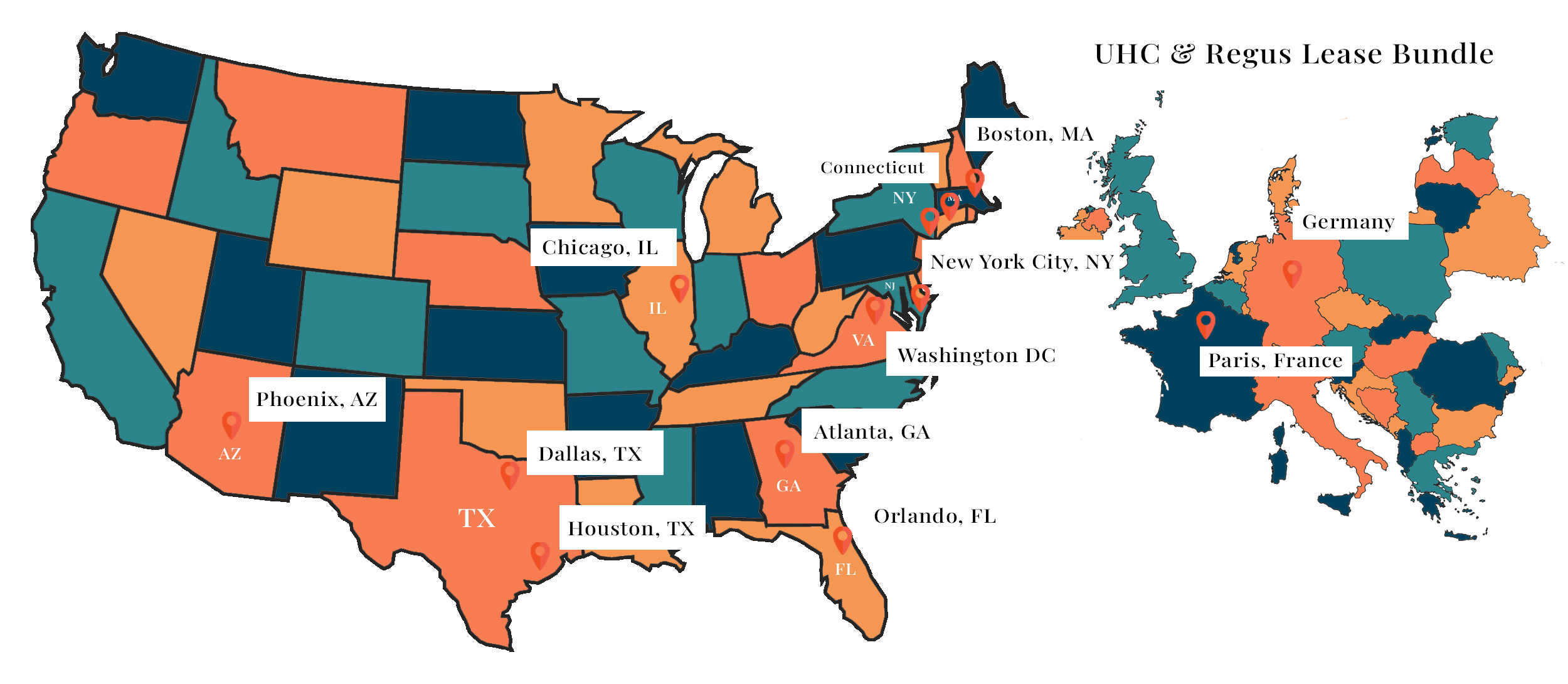

Lease Locations

Lease deals in Paris, Germany, NYC, Atlanta, Orlando, Phoenix, NJ, DC, Dallas, Houston, Chicago, Connecticut, and Boston.

Revenue Growth